In this post, we will see how to enter previous employment details i.e., previous employment income and tax deducted details in Saral TDS for Salary TDS computation.

Previous employment details are necessary for accurate calculation of TDS on salary. So, providing previous employer Income and TDS deducted details will reduce the chances of increased tax deduction.

Now, let us see step-by-step of this process.

Note: Ensure to enter proper joining date of the employee in Employee Master i.e., Employment From Date

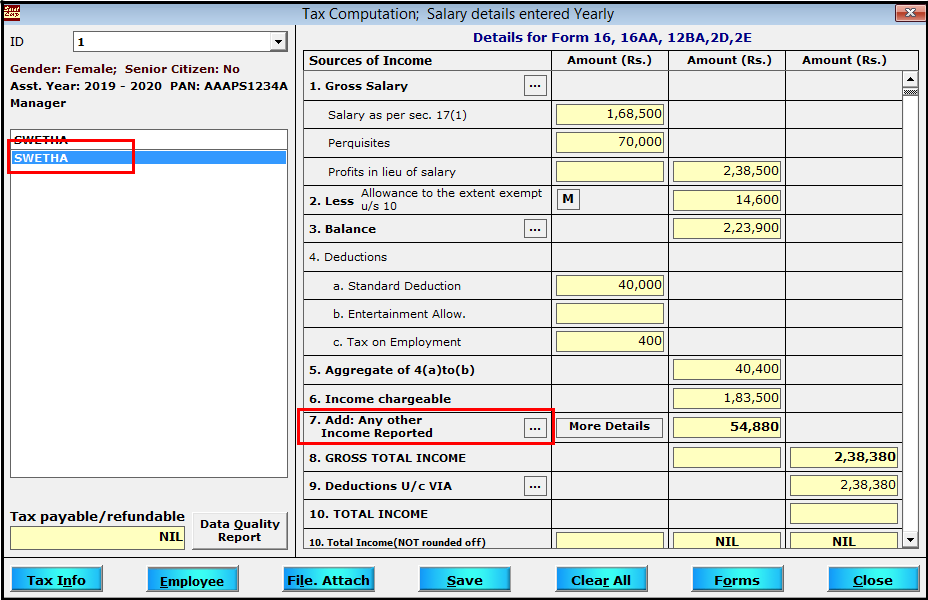

Go to Tax Computation under Form 24Q, select the required employee and click on “…” button against Add: Any other Income Reported option.

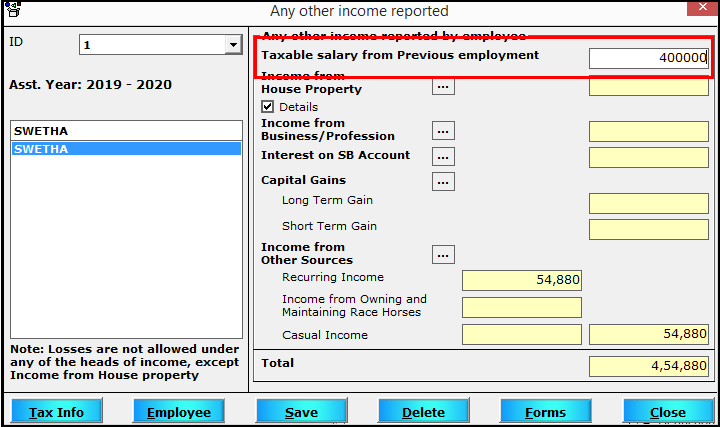

In the displayed window, enter the total income received for the current year of the previous employer in Taxable salary from Previous employment.

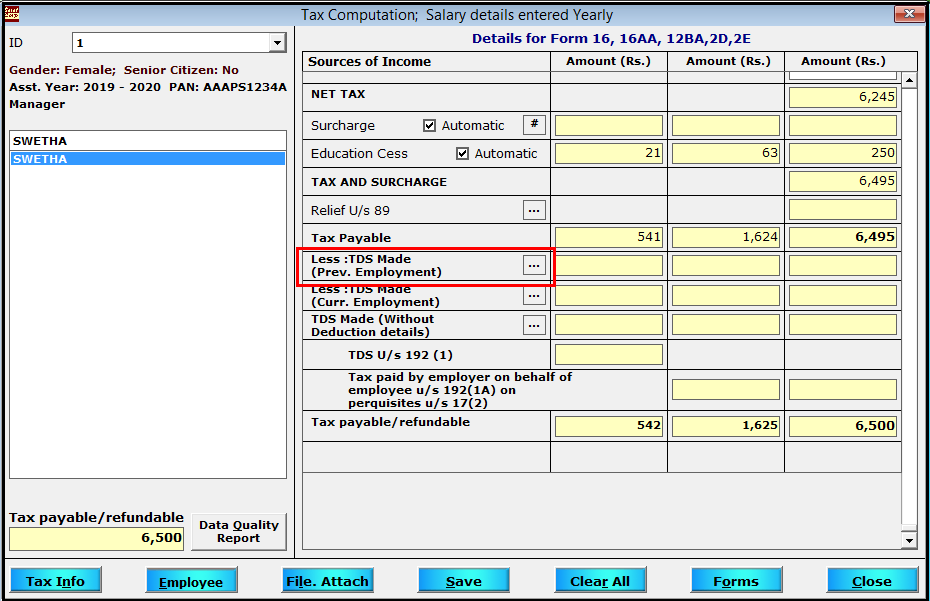

Next, go to Less: TDS Made (Prev. Employment) in Tax Computation window and click on “…” button.

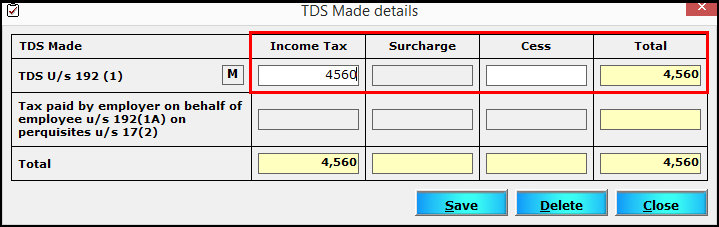

Here, enter the TDS deducted at previous employment.

This process will add the income to the taxable income and also less the TDS deducted to the extent of tax entered.

Note: It is not mandatory for the employee to disclose previous employment details. But, if disclosed by the employee then proper tax computation has to be done by the current employer.

This completes the process of entering previous employment details in Saral TDS. So, let us know your opinion by commenting below.