In this post, we are going to look into what is TDS Section 194N of Income Tax and its applicability and Non- applicability.

- Introduction to TDS Section 194N

- Applicability of Section-194N

- Non-applicability of Section-194N

- Example for Section-194N

- Important points

Introduction to Section 194N

The government of India is taking many measures to promote digital payments to make India a less-cash economy.

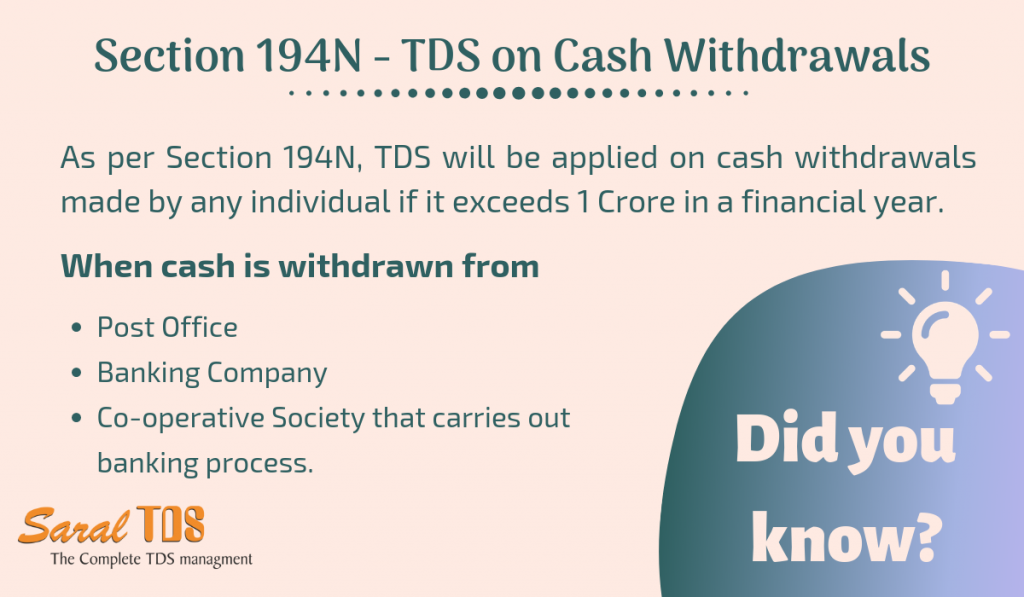

Section 194N of the Income Tax Act states that TDS will be applied on cash withdrawals made by any individual more than 1 Crore in a financial year. TDS is normally calculated at the rate of 2% on every cash withdrawal. Section 194N will come into action from September 1st, 2019.

Applicability of Section 194N

This Section 194N is applicable when the Recipient withdraws cash from the following:

- Banking Company (The Banking Regulation Act of 1949 must be applicable, otherwise any bank or banking institution referred to in Section 51 of this Act.)

- Co-operative Society that carries out banking process.

- Post Office

Non Applicability of Section-194N

Section 194N is not applicable to any Recipient if the payment is made to:

- To the Government of India

- Any Banking Company or Co-operative Society that is into banking procedure.

- To Post Office

- A business correspondent of a Banking Company or Co-operative Society that is into banking as per the Reserve Bank of India Act of 1934 by issued by the RBI.

- Any White Label ATM Operator (WLAO) or Co-operative Society which does banking according to RBI’s Payment and Settlement Systems Act of 2007.

- Any person or a class of persons, through a notification in the Official Gazette, as stated by the Central Government of India in relation with the Reserve Bank of India.

Example for Section-194N

Now let us see an example of how to apply Section-194N of Income Tax in everyday life situation:

If the total payments made by an individual till then was 99,70,000 and the present payment is Rs 1,00,000. The total payment is over 1 crore and which reached Rs 1,00,70,000.

Now we need to know if the TDS is applied on Rs. 70,000 or on Rs. 1,00,000. As per changes in Union Budget 2019, TDS is applicable at a rate 2% of Rs. 70,000 = 1,400 and the net payment to be made by a banker is Rs. 1,00,000 – Rs. 1,400 = Rs. 98,600.

Important Points

- Section 194N is applied to payments done in cash which is over Rs.1 Crore during a previous year from 1st of April of a particular year to the 31st of March of the following year.

- Banks and similar entities mentioned above generally make payments in cash instead of cheques. The respective account holders issue cheques. Therefore, the bearer cheque of a bank does not fall under the definition of cash in the context of this Section. So TDS is not applied in this situation.

- It is necessary for the banks and similar entities to maintain a record of every payment made in cash that is above Rs.1 Crore in the previous year.

- The limit of Rs.1 Crore is applicable for each and every account maintained by the bank or similar entities.

- As long as the recipient and the account holder are not the same, and the cash payment is through bearer cheques, then TDS will not be deducted.

- The provisions under Section 194N of the Income Tax Act also states the deduction is according to Income Tax.

- The different cases of that are exempted from the payments category include, payments made to the Government, Banks, Co-operative Societies and to Post Offices. For this reason, payments made to such entities are not a part of TDS deduction irrespective of the amount withdrawn as cash.

Read the notification here for more details

Related: Section 194M – TDS on payment to resident contractors and professionals

We have come to the end of this post. What do you think about this topic? Let us know in the comments section below.

Thanks for posting this type of blog. It helps to understand about Section-194N introduction, applicability. Keep writing and posting.

Thank you for reading and commenting. We are glad this blog was useful to you.

kindly provide detail for how to refund amount…