Latest amendment on TDS provisions due to Covid-19

Validity of Form 15G and 15H and Lower deduction certificate

CBDT issues orders u/s 119 of IT Act, 1961 to mitigate hardships to taxpayers arising out of compliance of TDS/TCS provisions:

- To mitigate the hardships of small taxpayers, it has been decided that if a person had submitted valid Forms 15G and 15H to the Banks or other institutions for F.Y. 2019-20, then these Forms would be valid up to 30.06.2020. This will safeguard the small tax payers against TDS where there is no tax liability.

- Assessees who have filed application for lower or nil deduction of TDS/TCS on the Traces Portal for F.Y.2020-21 and whose applications are pending for disposal as on date and they have been issued such certificates for FY 2019-20, then such certificates would be applicable till 30.06.2020 of F.Y. 2020-21 or disposal of their applications by the Assessing Officers, whichever is earlier, in respect of the transaction and the deductor or collector if any, for

whom the certificate was issued for F.Y. 2019-20. - Cases where the assessees could not apply for issue of lower or nil deduction of TDS/TCS in the Traces Portal for the FY 2020-21 but were having the certificates for F.Y. 2019-20, such certificate will be applicable till 30.06.2020 of F.Y. 2020-21. However, they need to apply at the earliest giving details of the transactions and the Deductor/Collector to the TDS/TCS Assessing Officer as per procedure prescribed in annexure.

- Cases where the assessee has not applied for issue of lower or nil deduction of TDS/TCS in the Traces Portal, and he is also not having any such certificate for F.Y.2019-20, a modified procedure for application and consequent handling by the TDS/TCS Assessing Officer is laid down which needs to be followed.

- Further, on payments to Non-residents (including foreign companies) having Permanent Establishment in India, where the above applications are pending, tax on payments made willbbe deducted at the subsidized rate of 10% including surcharge and cess, on such payments till 30.06.2020 of F.Y. 2020-21, or disposal of their applications, whichever is earlier.

In this post, we will take a look at the complete guide on Form 15G and 15H. We will discuss the following topics here:

- What is Form 15G and Form 15H?

- Purpose for submission

- Things to keep in mind

- Acknowledgement of submission

- Steps to be followed

- Due dates for Form 15G and 15H

What is Form 15G and Form 15H?

Banks can deduct TDS when your interest income per annum is above Rs.40,000 (before in FY 2019-20, Rs 10,000 was the limit). To calculate your limit, the bank will then consider all your deposits in their branches.

If the total income is below the limit, you can submit Form 15G and 15H to the bank to not deduct any TDS.

You can submit these forms online through the bank’s website. You need DSC and PAN to submit these forms online.

Form 15H is for citizens who are 60 years or above and Form 15G is for citizens under the age of 60, HUF or trust. Both Form 15G and 15H are only valid for a financial year.

Form 15G

The Form 15G is a declaration under sub-section (1) and (1A) of section 197A of the ITA. This Form is for the individual (not being a company or firm) claiming certain receipts without the deduction of tax.

The eligibility criteria to submit this form are:

- Individuals below the age of 60 years or by a Hindu Undivided Family (HUF).

- It is submitted before the first payment of interest on a fixed deposit.

- The individual should submit this form to each bank branch through which the individual is collecting interest.

- Individuals with zero tax amount payable on their total income.

- The individual should be a resident Indian.

The total interest income is less than the minimum exemption amount for that year. It is Rs.2.5 lakh for the financial year 2019-20 (AY 2020-21).

Form 15H

Form 15H is a declaration under sub-section (1C) of section 197A of ITA. It is for individuals to claim certain receipts without deduction of tax.

The eligibility criteria to submit this declaration are as follows:

- When you submit Form 15H, you must be 60 years or more.

- The estimated tax for the previous year should be zero. The individual should not have paid tax in the previous year because his/her income should be below the taxable amount.

- The individual should submit this form to each bank branch through which the individual is collecting interest.

- An individual has to submit it to the bank before the payment of the first interest. So that the bank will not deduct the TDS.

- You need to submit the Form 15H to the banks if the interest from one branch exceeds Rs.10,000 a year.

- You need to submit it if the interest income from any source other than a deposit (interest on a loan, advance, debentures, bonds, etc.) exceeds Rs.5,000 annually.

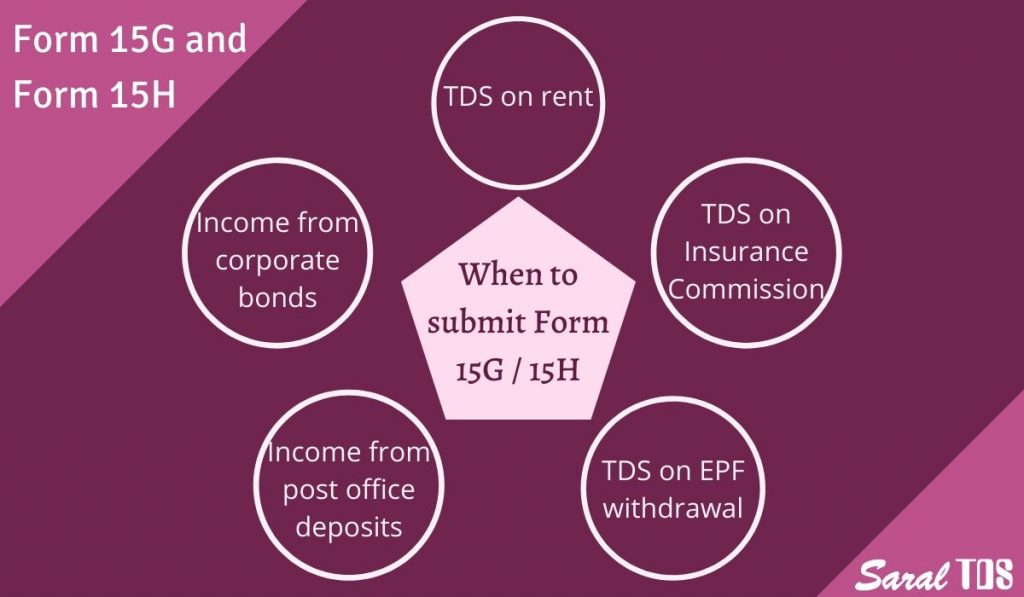

Purpose for submission

An individual will submit Form 15G and 15H to banks to prevent the TDS deduction on interest.

These forms are also submitted for other reasons:

- TDS on EPF withdrawal – There is a deduction of TDS on EPF if an individual withdraws their EPF before completion of 5 years of continuous service. If an individual has an EPF balance of more than Rs.50,000 and wishes to withdraw it before completion of 5 years of continuous service, then he/she may submit a Form 15G / 15H.

- TDS on income generated from corporate bonds – An individual is eligible for a deduction of TDS from corporate bonds when the income from these bonds exceeds Rs.5,000.

- Tax deducted at source (TDS) on income from post office deposits – Digitized post offices also deduct TDS and will accept Form 15G / 15H if the individual meets the eligibility criteria.

- TDS on rent – There is a deduction of TDS on rent if the total rental payment for a year exceeds Rs.1.8 lakhs. If the individual’s total income is nil, he/she can submit Form 15G / 15H to request the tenant to not deduct TDS.

- TDS on Insurance Commission – TDS is deducted from insurance commission if it exceeds Rs 15000 per financial year. But with effect from 01.06.2017 insurance agents can submit Form 15G/15H for non-deduction TDS. They can do this if the tax on their total income is nil.

Things to keep in mind

- An individual can only submit Form 15G and 15H to a bank with a valid PAN if not, the tax is deducted @ 20%. It is advisable to submit a copy of the PAN card with the cover letter.

- The individual should make sure he/she receives an acknowledgement while submitting Form 15G / 15H. Acknowledgement of submission of Form 15G / 15H details is useful if a dispute with the bank arises.

- As per the revised form, the individual will need to submit the details of the Form 15G / 15H submitted by him/her to other banks as well as the interest income amount mentioned in these forms.

- As the individual has submitted his / her PAN, the respective assessing officer will have access to all the information submitted by the individual to other banks. So they can detect any incorrect information submitted by the individual.

- If an individual provides incorrect information in the forms, he can be put into jail for a minimum of 3 months.

- An individual can submit these forms online through some bank’s website. Some banks also collect them in paper format. Then later they convert it into electronic format.

- Form 15G / 15H is valid for one financial year. So you have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure the banks don’t deduct any TDS on your interest income.

Acknowledgement of submission

The Deductor, after due verification of the self-declaration, has to assign a unique identification number (UIN) to the declaration.

The unique identification number (UIN) allotted to the declaration has to contain the following fields:

- A sequence number as shown in the table;

- the financial year for which the declaration is being provided and TAN of the Deductor.

| 15G | 15H |

|---|---|

| 10 alphanumeric character starting with G followed by 9 digits (Eg. G000000001) |

10 alphanumeric character starting with H followed by 9 digits (Eg. H000000001) |

The UIN running sequence number series would be reset to 1 at the start of each FY, in case of each TAN of the deductor.

The sequence number must be a ten-digit alphanumeric string of characters, starting with G or H for Form 15G and 15H respectively.

Steps to be followed by the deductor

The deductor will have to digitize the declaration given on paper and upload all the declarations. Also, including the electronic declarations on the department website. These declarations are to the uploaded quarterly by the deductor.

The Deductor has to quote the UIN in quarterly Statement. It has to be against the transaction which is covered under the Form 15G / 15H declaration.

It is also mandatory to quote the same in the “Certificate Number” field for the Form26Q return statement. Also, where the Deduction remark is set to “NO DEDUCTION U/S 197A”.

This is applicable to statements which pertain to the Financial Year 2015-16, Quarter 3 onwards.

Due dates for Form 15G and 15H

The following table gives a clear indication of the due dates for declarations received from 1st April 2016 onwards:

| Date of ending of the quarter of the FY | Due Date |

|---|---|

| 30th June – 1st Quarter | 15th July |

| 30th September – 2nd Quarter | 15th October |

| 31st December – 3rd Quarter | 15th January |

| 31st March – 4th Quarter | 30th April |

This ends our post. If you have any questions kindly drop them in the comment section below.

Related:

You can also see how it works in Saral TDS: